Some Ideas on Summit Business Advisors Llc You Need To Know

Table of ContentsA Biased View of Summit Business Advisors LlcWhat Does Summit Business Advisors Llc Do?Summit Business Advisors Llc - TruthsSome Known Details About Summit Business Advisors Llc The Single Strategy To Use For Summit Business Advisors LlcA Biased View of Summit Business Advisors LlcThe Summit Business Advisors Llc Statements

A great financial advisor understands this and prepares your financing in a manner that your tax outgo is minimum. High tax obligations indicate low returns. Even relatively encouraging financial investments can end up being a wrong choice as a result of the connected taxes. An independent financial expert functions as your savior below.The function of an independent financial consultant requires them to be a vibrant researcher. In-depth research studies on various sectors, industries, and markets help them stay affordable. They are well-updated on various sectors, economic markets, risks, existing laws, taxes guidelines, and various other areas of economic administration. Hence, when you approach them with your issues, they are well outfitted to assist you make educated decisions.

In a rapid and progressive globe, you currently have a lot on your plate. Also though you want to, it is rather feasible that you discover it hard to take time from your hectic timetable for managing your finances. With a monetary expert by your side, you can be care-free regarding your cash.

Top Guidelines Of Summit Business Advisors Llc

While you are functioning, monetary consultants can make your money work for you. They deal with a wide variety of economic obstacles and obligations in your place and find optimum methods for wealth creation. Economic consultants not only bring years of experience to the table but additionally have a clear point of view.

Financial advice can be beneficial at turning factors in your life. Prior to they make any type of recommendations, an advisor ought to take the time to review what's crucial to you.

Insist that you are alerted of all purchases, and that you get all communication relevant to the account. Your consultant might recommend a managed optional account (MDA) as a means of managing your investments. This entails signing an arrangement (MDA agreement) so they can purchase or market investments without having to talk to you.

The 25-Second Trick For Summit Business Advisors Llc

To safeguard your money: Don't give your advisor power of lawyer. Urge all document about your investments are sent out to you, not just your advisor.

This may happen during the meeting or electronically. When you go into or renew the continuous cost setup with your adviser, they ought to explain exactly how to finish your connection with them. If you're transferring to a new advisor, you'll need to organize to transfer your economic documents to them. If you require aid, ask your consultant to describe the process.

The sensible financier is anything but. On a daily basis, individuals make unreasonable choices based on feelings not because they aren't clever however as a result of exactly how they're wired. Behavior financing acknowledges this difficulty and gives economic experts the devices they require to assist their customers make rational choices when they otherwise would not.

Summit Business Advisors Llc Can Be Fun For Everyone

This area identifies that capitalists aren't rational which their feelings can affect their financial investment (https://www.ted.com/profiles/48024971/about) options. Worry, greed, insolence, anchoring predisposition, loss hostility and familiarity predisposition are simply some of the psychological variables that result in inadequate decision-making and suboptimal investment results. By researching investor psychology and comprehending the duty of emotions in economic decision-making, financial consultants can find out a lot more about their customers' inspirations and offer even more efficient assistance and assistance.

Both bears will scare us: Among which is deadly, and the various other is not." You likewise can think of typical and behavior finance as 2 sides: one is standard finance (technological and essential), and the various other is behavioral. You can't have a coin without both sides. Whatever example you like, monetary advisors who understand these distinctions can customize their guidance and approaches to better line up with their customers' demands and choices.

Right here are some other advantages financial experts can recognize. When financial experts have a deep understanding of behavioral money, they're much better equipped to ask about and identify their clients' actions, predispositions, and feelings.

7 Simple Techniques For Summit Business Advisors Llc

One way consultants can supply ongoing value is by identifying that they remain in a partnership with customers, and they need to nurture it. By strengthening these connections, experts can better anticipate and attend to possible investing pitfalls, including psychological choices. And instead of marketing customers the easiest or a lot of basic products, monetary consultants can reveal customized remedies that also make financial sense.

Financial resources matter, however that's not the only consideration. Behavioral finance aids experts focus their connections with clients in trust fund and compassion rather than just bucks, numbers and monetary optimization. One method consultants can show empathy is by taking an action back.

The 10-Minute Rule for Summit Business Advisors Llc

If you want to apply behavioral money in your method, you need to blaze a trail. When you've understood the concepts, you'll be prepared to help your clients. Find out more concerning some of the behaviors of successful monetary experts. Start by recognizing your very own biases and psychological triggers. Mirror on your decision-making processes, and recognize any kind of patterns of unreasonable habits.

It won't make any individual smarter, yet it will certainly raise and improve their access to their intelligence." Clarify your own values and exactly how they line up with your technique to monetary suggesting. We understand that living out of positioning is a source of anxiety and frustration which those are simply a few of the aspects that activate psychological feedbacks and inadequate decision-making.

Our values card exercise is available in a free, interactive online tool and a physical card deck for purchase. You (and your clients) have choices for when, where and exactly how you intend to sort through and prioritize your values. Simply as you require to specify your worths, assist your clients do the same.

Getting The Summit Business Advisors Llc To Work

Investors might feel discomfort dealing with finance problems for a wide variety of reasonsfrom basic dullness to a lack of time - Project Accounting. Despite where clients get on this range, consultants can address this requirement by building and maintaining count on. Without this assurance, a concerned client may not believe an advisor that states they're on track to reach their goals, and a time-deprived customer could not hand off tasks

Joseph Mazzello Then & Now!

Joseph Mazzello Then & Now! Christina Ricci Then & Now!

Christina Ricci Then & Now! Jennifer Love Hewitt Then & Now!

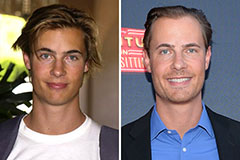

Jennifer Love Hewitt Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now! Jeri Ryan Then & Now!

Jeri Ryan Then & Now!